Introduction

When we talk about effective strategies to improve financial path and growth, you must realize that achieving growth and financial stability requires careful planning, informed decision-making, and continuous effort. By improving your financial path, you can secure a more prosperous future. Below are the most important financial growth strategies that will help you grow your wealth and achieve financial success.

1. Assess Your Current Financial Situation

Before you can improve your finances, you need a clear understanding of your current situation. This involves analyzing your income, expenses, debts, and assets.

Steps to Assess:

- Track Income and Expenses: Use budgeting tools or apps to monitor where your money goes.

- Calculate Net Worth: Subtract your total liabilities from your total assets.

- Identify Financial Leaks: Look for unnecessary expenses that can be reduced or eliminated.

2. Set Clear Financial Goals

Setting specific, actionable financial goals provides direction and motivation. Break down your goals into short-term, medium-term, and long-term objectives.

Examples of Financial Goals:

- Short-Term: Save $1,000 for an emergency fund within three months.

- Medium-Term: Pay off $5,000 in credit card debt within a year.

- Long-Term: Save $50,000 for a down payment on a house within five years.

3. Create and Stick to a Budget

A budget is an essential tool for managing your finances. It helps you control your spending, save money, and ensure you’re living within your means.

Budgeting Tips:

- Categorize Expenses: Divide your spending into essential and non-essential categories.

- Use the 50/30/20 Rule: Allocate 50% of your income to needs, 30% to wants, and 20% to savings and debt repayment.

- Adjust as Needed: Regularly review and adjust your budget to reflect changes in your financial situation.

Take control of your finances today. Click here to master cash flow management and secure your financial future!

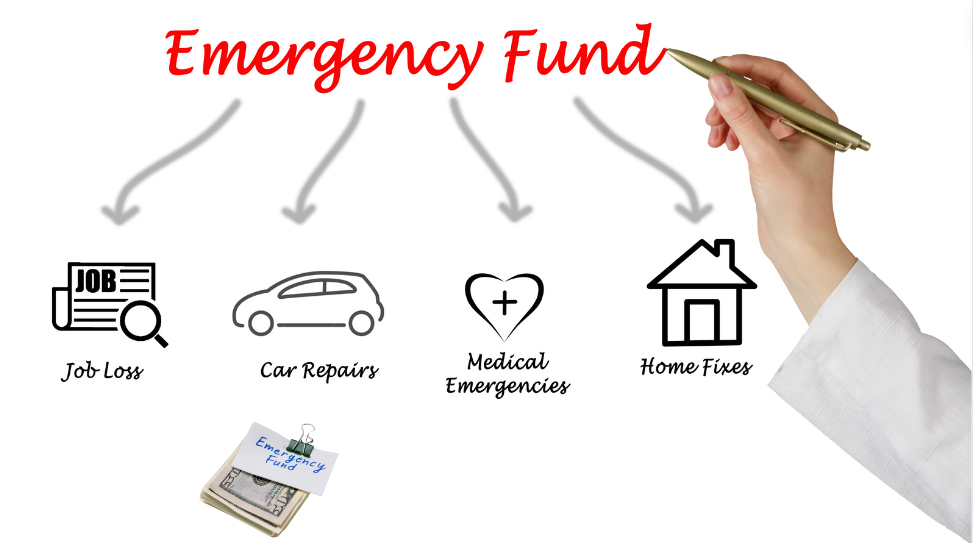

4. Build an Emergency Fund

An emergency fund acts as a financial safety net, protecting you from unexpected expenses and financial shocks.

Building Your Fund:

- Set a Goal: Aim to save three to six months’ worth of living expenses.

- Automate Savings: Set up automatic transfers to your emergency savings account.

- Start Small: Begin with small, consistent contributions and gradually increase them.

5. Reduce and Manage Debt

Debt can hinder your financial growth, so it’s important to develop a strategy for managing and reducing it.

Debt Management Strategies:

- Debt Snowball Method: Focus on paying off the smallest debts first to build momentum.

- Debt Avalanche Method: Prioritize debts with the highest interest rates to save on interest payments.

- Consolidate Debt: Consider consolidating high-interest debts into a lower-interest loan.

6. Invest Wisely

Investing is crucial for growing your wealth over the long term. Diversify your investments to spread risk and increase potential returns.

Investment Options:

- Stocks and Bonds: Stocks offer high growth potential, while bonds provide stability and regular income.

- Mutual Funds and ETFs: These provide diversification and professional management.

- Real Estate: Investing in property can generate rental income and capital appreciation.

Ready to master affiliate marketing? Join our Super Affiliate Marketing Mastery program now!

7. Increase Your Income

Boosting your income can accelerate your financial growth. Look for opportunities to earn more through your current job or additional sources.

Ways to Increase Income:

- Ask for a Raise: Present a case for why you deserve a salary increase based on your performance and contributions.

- Side Hustles: Start a part-time business or freelance work in your area of expertise.

- Invest in Education: Enhance your skills and qualifications to improve your job prospects and earning potential.

8. Monitor and Adjust Your Financial Plan

Regularly review your financial plan to ensure you’re on track to meet your goals. Be prepared to make adjustments as your circumstances change.

Monitoring Tips:

- Monthly Reviews: Check your budget and spending regularly.

- Annual Reviews: Assess your overall financial progress and make any necessary changes.

- Stay Informed: Keep up with financial news and trends to make informed decisions.

Conclusion

Optimizing your financial track involves a combination of strategic planning, disciplined budgeting, wise investing, and ongoing review. By implementing these strategies, you can achieve financial growth, build wealth, and secure a stable financial future. Start today and take control of your financial destiny.