Introduction

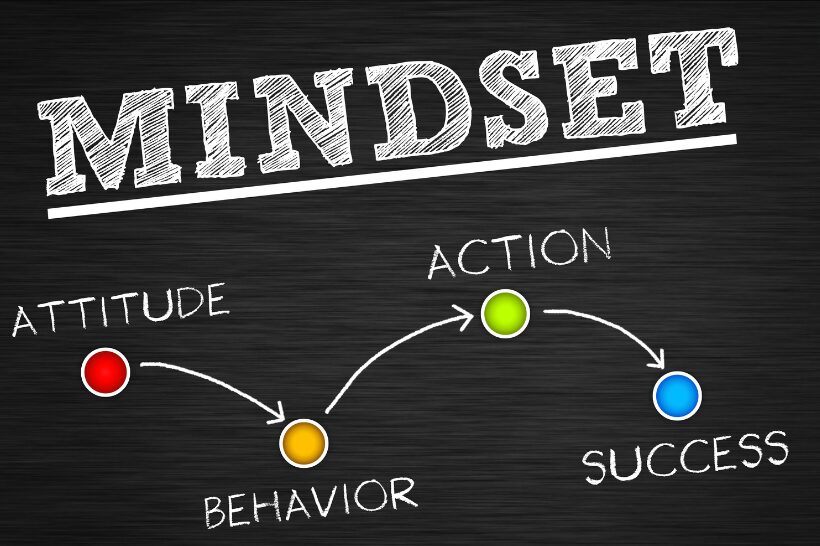

When it comes to financial success, the right mentality is often the most critical factor. Your mindset influences your financial decisions, habits, and ultimately, your wealth. Here’s why mentality matters most and how you can cultivate a mindset that drives financial success.

1. The Power of a Positive Mindset

A positive mindset shapes how you perceive and respond to financial challenges. Optimism and confidence in your financial abilities can lead to better decision-making and resilience in the face of setbacks.

Benefits of a Positive Financial Mindset:

- Increased Motivation: A positive outlook fuels the drive to pursue and achieve financial goals.

- Resilience: Optimism helps you recover from financial setbacks and maintain focus on your long-term objectives.

- Opportunities: A positive mindset opens your eyes to opportunities that others might overlook.

2. Overcoming Limiting Beliefs

Many people harbor limiting beliefs about money that can hinder their financial growth. These beliefs often stem from past experiences, societal conditioning, or fear of failure.

Common Limiting Beliefs:

- “I’m not good with money.”

- “I’ll never be wealthy.”

- “Money is the root of all evil.”

Strategies to Overcome Limiting Beliefs:

- Identify and Challenge: Recognize limiting beliefs and challenge their validity.

- Replace with Positive Affirmations: Use positive affirmations to reframe your mindset.

- Seek Knowledge: Educate yourself about personal finance to build confidence and competence.

3. Embracing a Growth Mindset

A growth mindset, the belief that abilities and intelligence can be developed through effort and learning, is crucial for financial success. This mindset encourages continuous improvement and adaptability.

How to Develop a Growth Mindset:

- View Challenges as Opportunities: See financial challenges as chances to learn and grow.

- Embrace Learning: Continuously seek knowledge and skills related to personal finance.

- Celebrate Progress: Acknowledge and celebrate small financial victories along the way.

Transform your mindset and achieve success. Discover the key differences between rich and poor perspectives on success. . Click here to learn more

4. Setting and Achieving Financial Goals

A goal-oriented mindset helps you set clear, actionable financial goals and stay committed to achieving them.

Tips for Goal Setting:

- Be Specific: Clearly define what you want to achieve.

- Break Down Goals: Divide larger goals into smaller, manageable steps.

- Stay Accountable: Regularly review your progress and adjust your plan as needed.

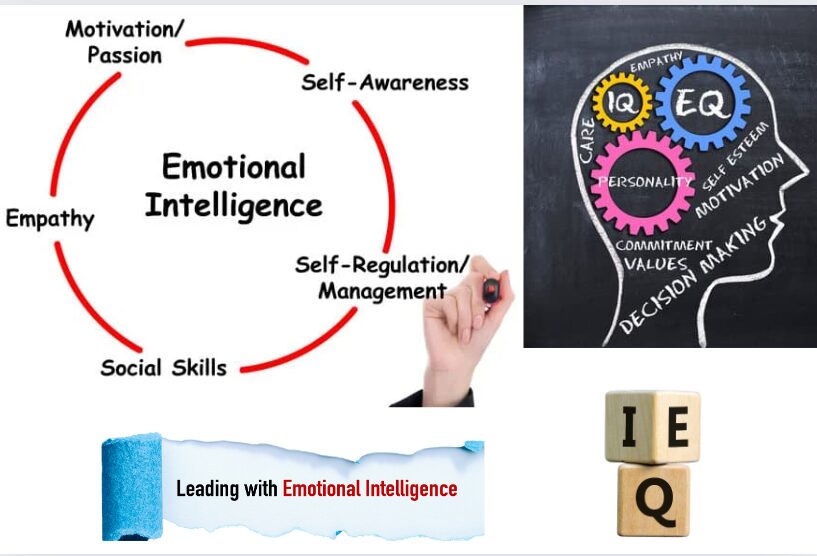

5. The Impact of Emotional Intelligence

Emotional intelligence, the ability to understand and manage your emotions, plays a significant role in financial success. It helps you make rational decisions, avoid impulsive spending, and handle financial stress.

Enhancing Emotional Intelligence:

- Self-Awareness: Recognize your financial habits and triggers.

- Self-Regulation: Develop strategies to manage impulsive spending and financial stress.

- Empathy: Understand and consider others’ perspectives in financial decisions.

6. Building Financial Discipline

Discipline is essential for sticking to a budget, saving regularly, and making prudent investments. A disciplined mindset helps you prioritize long-term financial health over short-term gratification.

Developing Financial Discipline:

- Create a Budget: Plan and track your spending to stay within your financial limits.

- Automate Savings: Set up automatic transfers to your savings and investment accounts.

- Set Boundaries: Establish rules for discretionary spending to avoid impulse buys.

Ready to unlock the potential of earning while you sleep with Passive Income System 2.0. Click here to get started and take control of your financial future!

7. Staying Resilient in Financial Setbacks

Financial setbacks are inevitable, but a resilient mindset enables you to bounce back stronger. Resilience involves maintaining a positive attitude and a problem-solving approach in the face of financial difficulties.

Building Financial Resilience:

- Emergency Fund: Maintain an emergency fund to cushion against unexpected expenses.

- Flexible Planning: Be prepared to adjust your financial plans as circumstances change.

- Learn from Mistakes: Analyze financial setbacks to identify lessons and prevent future errors.

Conclusion

Mind over money is a powerful concept that underscores the importance of mentality in achieving financial success. By cultivating a positive mindset, overcoming limiting beliefs, embracing a growth mindset, setting and achieving goals, enhancing emotional intelligence, building financial discipline, and staying resilient, you can master your finances and pave the way to lasting wealth and financial well-being. Start today by shifting your mindset and watch how it transforms your financial life.

Pingback: Mindset Matters - Rich vs. Poor Perspectives on Success -